Today, we’re talking about how to save like a squirrel. You might be wondering why—well, let me explain.

As Tiffany Aliche, the author of Get Good with Money and owner of The Budgetnista website, points out, squirrels, indeed, have a lot to teach us about saving. During spring and summer, they diligently store acorns for the winter. It’s a simple yet powerful lesson in planning and saving. Therefore, in this post, we’ll explore what squirrels naturally do and, consequently, why we can learn a thing or two from these furry little savers when it comes to our finances.

There isn’t much food available for the squirrel during the colder months. Consequently, these little animals know that food will be scarce. So, besides eating to keep body and soul together during summer, they also go the additional mile by storing lots of seeds, nuts, and acorns to get them through the challenging days ahead when food will be in short supply.

Your Saving Mindset

We often think animals aren’t as smart as humans, but squirrels grasp a concept we struggle with—planning for the future. So, who’s really more intelligent?

I wasn’t like a squirrel when it came to saving. In fact, I was terrible at it. Could I afford to set money aside? Yes. Was it necessary? Absolutely. So, why wasn’t I doing it? Even a 4-year-old knows saving is important. That’s why I’m not giving you a 10-point list of why you should save. You already know it’s crucial. Everyone I’ve coached knows it, too, but they still don’t save.

Why Don’t We Save Like a Squirrel?

I always wanted to save, but I usually went about it in one of two ways.

First, I’d get paid, and without any real planning, I’d move a large chunk of money into my savings, determined to keep it there. But then, because I had not planned or set aside enough to cover my bills, I’d end up dipping into my savings for bills, and once I started digging into my account, I couldn’t stop until it was all gone.

The other option was to pay all my bills first and save whatever was left. The problem was that there was never anything left, and it felt like a never-ending cycle.

Fearing Debt Consequences Over Saving Benefits

I had a loan with a £300 monthly payment. I always paid on time because I didn’t want to mess up my credit. When I finally paid it off, I was determined to put that £300 into savings—but I just couldn’t.

I made those loan payments because the consequences of missing them, like damaging my credit, were serious. But with saving, there were no immediate consequences if I didn’t do it. I was more focused on avoiding problems than on the benefits of saving for myself.

After years as a money coach, I’ve realised I’m not alone in this struggle. The old approaches just don’t work. We need a new way to think about saving.

Building Healthy Saving Habits

I am now a recovered non-saver; I save regularly and enjoy the process. As is my habit, I am here to share how I became good at saving.

Save Like a Squirrel and Pay Yourself First

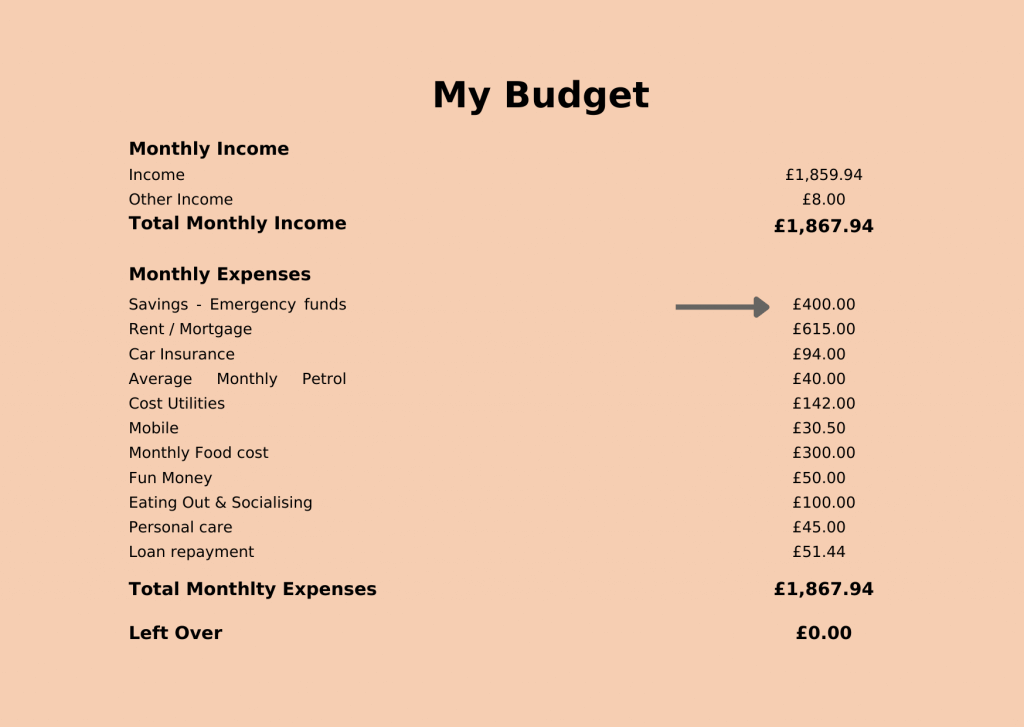

Paying yourself first means putting money aside before spending it on anything else. It means that as soon as you get your income, you PLAN how you will spend it with the help of a budget. Your saving is the first spending category in your budget.

This means you’re looking out for your future financial well-being and paying bills or buying things now.

Budgets Are Good

A budget helps you decide where your money should go, making sure you cover all the important things you need to spend on. It’s different from what I used to do.

With a budget, you list your income and everything you need to spend money on. Saving money should be at the top of that list. If you realise there’s not enough money for everything, you might need to adjust some things or delay buying others.

Budgetting just tells you you can’t have everything you want, which is why many people dislike it. You might have to put off buying some items or decide against buying them altogether.

How Much Should I Save?

When you’re just starting to save, the key isn’t how much you save at first but building the habit of saving and resisting the urge to dip into your savings. I recall beginning with just £5. I aimed to get comfortable with setting money aside and not touching it. Over time, I got the hang of saving and not touching my savings, and then I began to put away more money. But remember, before you save anything, ensure you’ve planned for it in your budget. This way, you’ve accounted for all your essential expenses, including your savings.

Emergency Funds

People often ask me, “What should I save for first?” My answer is always the same: save for emergencies. Think of squirrels—they save for tough times ahead. We need to be realistic; emergencies happen whether we like it or not. It’s not being negative, just facing reality. Squirrels get it, and so should we.

An emergency fund is your financial safety net for unexpected situations, like a car breakdown or surprise bills. Aim to save 3-6 months’ worth of expenses. The more you can save, the better prepared you’ll be.

Replenishing After an Emergency

If you have an emergency and need to tap into your fund, replenish it as soon as possible following the same principles of planning and budgeting.

Where to Put Your Emergency Fund

For your emergency fund, choose a safe and easy-to-reach account. You can use a regular savings account at a physical or online bank. Access to your money quickly during an emergency is essential, but it’s also important not to mix it with your everyday spending money. Keep them separate but accessible.

Automate Your Savings

Automating your savings is like making your money-saving process super easy and effective. Here’s how it works:

- Set Up Automatic Transfers: You can ask your bank to do this. They’ll automatically move a certain amount of money from your regular account to your savings account. You tell them how much and how often.

- Consistency: With automation, you save money without even thinking about it. It’s like having a helpful robot that helps you save like a squirrel regularly. You don’t have to lift a finger.

- Reduce Temptation: Since the money goes straight into your savings account, you’ll be less likely to spend it on things you don’t need or just splurge on something fun.

- Build Good Habits: Automating savings helps you build excellent money habits. After a while, you’ll be used to living with what’s left after saving, and that’s when you’ll reach your financial goals.

- Grow Your Emergency Fund: Automation ensures steady progress if you’re rebuilding your emergency fund or saving for something unique.

- Peace of Mind: Knowing you’re always saving for the future can give you a sense of security, like having a safety net for your finances. And remember, in this series, we’re all about finding peace of mind with our money.

Helping You Save Like a Squirrel

Moving from not saving to becoming someone who saves regularly means changing how you think about money. You’ve got to realise that not saving can lead to money troubles and maybe even debt. Saving is like a habit, something you do regularly, like working out. It might mean giving up some other things you like to spend money on, but it’s worth it.

Don’t worry if you need a little push to get started. Here are some ways to help you get into the habit of saving.

The 6-Month Saving Challenge

A 6-month saving challenge is like a fun game where you save a little money every month for half a year. Here’s how it works:

- Start Small: In the first month, you save a small amount, like £1 or any manageable amount. I began with just £5.

- Add a Bit Each Month: Each month, you put aside a bit more than the previous month. So, in the second month, you save a bit more than in the first month.

- Keep Going: You keep doing this for six months, saving more each time. It’s like a little savings adventure that gets more exciting as you go.

- Celebrate Your Progress: Don’t forget to celebrate how far you’ve come!

- See Your Savings Grow: By the end of the challenge, you’ll have saved up some money. Watching your savings grow without feeling like you’re giving up too much is fun.

Joining a Saving Community

A savings group can be like having friends who help you, keep you on track, and show you different ways to save money.

Now, you might wonder, “Where can I find a group like this?” Well, the answer is on social media. But here’s a tip: Look for a group that will help you, not make things more challenging. That’s why I created the Simple Money Hacker’s Facebook group. It’s a friendly place where people who want to improve their money get together. You can join us right here and see how being part of this supportive community can help you.

I write other exciting stuff; learn more about Simple Money Hacks here.

Final Thoughts

Taking a page from the squirrel’s book of saving. Learn to save like a squirrel and make your financial future brighter and safer. We’re on the path to financial success when we learn from the squirrel’s mindset, set goals, make good saving habits, and join a saving group. No matter what life throws at us, we can thrive. So, let’s embrace the squirrel’s lessons and save for tomorrow. Your money’s health relies on it!

This blog is Part 3 of our Financial Peace of Mind series. In Part 1, we emphasised why having a process to transform your finances is crucial. Part 2 looked into the best way to set your financial goals. If you haven’t read them yet, catch up here. And now, take action and join us on this journey to financial peace of mind!

Thanks for being here. I will see you in the next blog.