Budgeting can feel like a chore, but it’s one of the most empowering tools for achieving financial freedom. In 2025, let’s change the way we think about money, starting with these simple budgeting tips for 2025. Whether starting from scratch or wanting to refine your process, these tips will help you take control of your finances.

Tip 1: Bust the Budgeting Myths Holding You Back

Budgeting myths stop many of us from reaching our financial potential. Let’s tackle some common ones:

- Myth: Budgets are only for the wealthy.

Truth: Budgets help everyone, especially those with limited income. They highlight areas where you can cut back and redirect money towards building wealth. - Myth: Budgeting means no fun.

Truth: Budgets are about balance. The 50/30/20 rule, for example, dedicates 30% of your income to things you enjoy. Life shouldn’t feel restrictive! - Myth: Irregular income makes budgeting impossible.

Truth: A multi-month budget lets you plan for high and low-income periods, ensuring you stay on track.

The first step to better money management in 2025 is rejecting these myths and embracing budgeting as a tool for freedom.

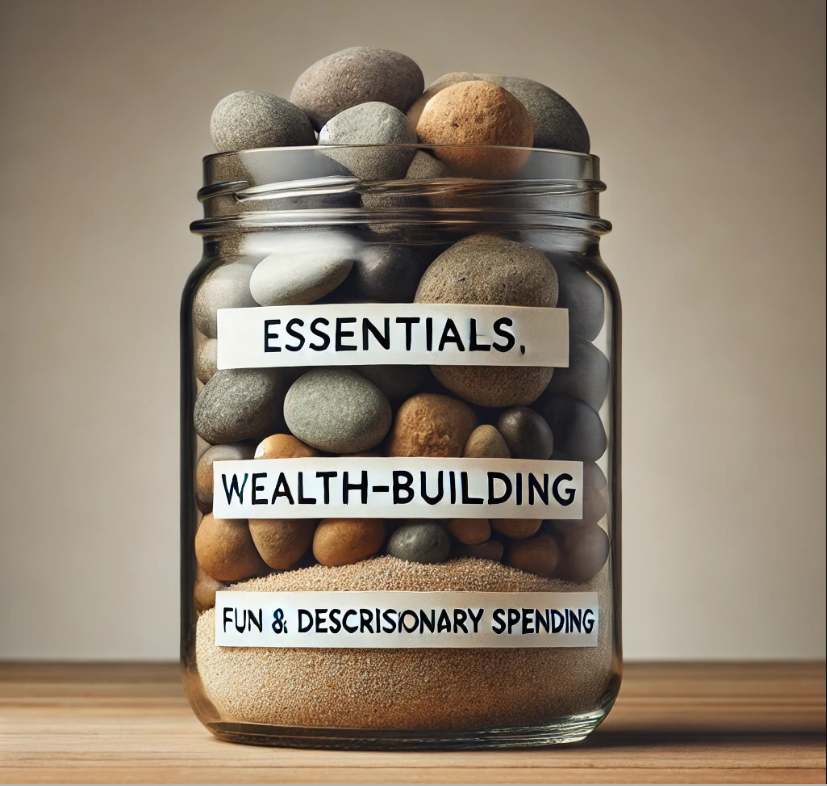

Tip 2: The Rock, Pebble, Sand Game—Master Prioritisation

Imagine your income as a jar, and your expenses fall into three categories:

- Rocks: Your essential expenses—rent, utilities, and groceries.

- Pebbles: Wealth-building activities like saving, investing, and paying off debt.

- Sand: Fun and discretionary spending—nights out, hobbies, and non-essentials.

Most people pour the sand into the jar first, spending money on fun, and then try to squeeze in pebbles (wealth-building) and rocks (essentials). The result? There’s never enough room for everything.

Here’s how to fix that:

- Start with the rocks. Prioritise essentials first to secure your foundation.

- Add the pebbles. Next, allocate funds for wealth-building.

- Pour in the sand. Whatever is left can be used for discretionary spending.

When done in this order, everything fits perfectly. This analogy teaches us that prioritising the right expenses is key to maximising limited resources. If you focus on what truly matters, there’s still room for enjoyment—just not at the cost of your financial security.

Tip 3: Apply the 50/30/20 Rule to Simplify Budgeting

The 50/30/20 rule simplifies budgeting by dividing your income into three categories:

- 50% for essentials: Rent, utilities, and groceries.

- 30% for discretionary spending: Entertainment, dining out, or hobbies.

- 20% for wealth-building: Saving, investing, and debt repayment.

This framework helps you manage your money without feeling overwhelmed. I must emphasise that there is no one-size-fits-all approach. Adjust the percentages to align with your financial goals, and you’ll be on the right track.

When I first tried the 50/30/20 rule, my essentials accounted for a staggering 105% of my income. I was shocked but didn’t let it discourage me. Instead, I started trimming non-essentials and finding ways to increase my income. Little by little, I reduced my expenses until they fit within 50% of my earnings. If I could do it, you could, too. I hope this story inspires you to take that first step!

Tip 4: Tackle Irregular Income with a Multi-Month Budget

Irregular income can feel unpredictable, but a budget can help you ride the waves. Think of the story of Joseph in Egypt, who planned during good harvests for the famine years. The same principle applies to your finances.

- During high-income months, save aggressively for the lean months.

- Download my multi-month budget on my resource page and plan 3–12 months ahead.

Example: If you earn £8,000 in January but anticipate low earnings in February and March, allocate the £8,000 to cover your expenses across all three months. This forward-thinking approach keeps you prepared and secure.

Tip 5: Give Every Pound a Job with Zero-Based Budgeting

A zero-based budget (ZBB) ensures you assign every pound a purpose, from covering bills to saving for the future. Ultimately, your income minus expenses equals zero—nothing is unaccounted for.

Example:

If you earn £3,630 monthly, your budget might look like this:

| Income | £3,630 |

| Minus expenses | |

| Essentials | £1,815 |

| Financial Goals | £1,015 |

| Discretionary spending | £800 |

| Total Expenses | £3,630 |

| Income minus expenses | £0.00 |

ZBB helps you plan ahead and prevents wasteful spending. It also makes room for the things you enjoy guilt-free because you’ve accounted for them.

Final Thoughts: Start Your Journey Today

Budgeting is a skill that takes time to master, but the benefits are well worth it. With a little consistency, you’ll reduce financial stress, feel more in control, and gain confidence in achieving your goals.

If you’d like to dive deeper into budgeting and learn more strategies, I cover this topic extensively in my book, The Black Woman’s Guide to Building Wealth. It’s packed with actionable advice to help you build lasting wealth and take control of your finances. Don’t wait—your financial transformation starts today!

Looking for more money tips? Join my newsletter 👇👇👇for more practical money tips delivered to your inbox. For daily budgeting hacks, smart spending tips, and a peek into my money journey, follow me on Instagram!

Related:

👉 17 Ways to Save Money on Groceries

👉 12 Effective Goal Setting Techniques